Retired C.O. of NYPD Financial Crimes Chris Flanagan weighs in today on the under-reported story of how bad the Covid relief program truly was.

Folks, here’s a shot of two restaurants recently shuttered in Hell’s Kitchen:

That’s Casa del Toro and Le Prive, both owned by the same “hospitality group.” According to West 42st magazine, both were recently closed by the City of New York, with eviction notices posted. Why?

Because in 2021, after a joint investigation by DOJ, NYPD, and the U.S. Secret Service, the owners were charged with engaging in a $17 million embezzlement scheme. Those charged are alleged to have stolen money from an electronics firm — with at least some of the funds shuttled to the restaurants.

So? Well, according to the magazine:

One of the surprises on the (restaurant grant) list was the award of over $858,850 to Prive Hospitality Group LLC… before the grant was awarded, the owner, Sanjay Laforest, was reported to be facing $17 million embezzlement charges.

Got that? The owner was indicted by the federal government… after which he received a massive federal covid grant! (According to the SBA website, he also received $260,729 in PPP funds that is marked “exempted”).

One example, in one neighborhood known to us. How many others?

Lots.

As we head into the midterms… shouldn’t we be hearing more about what likely aggregates to the most massive fraud ever?

Folks, our government can mismanage anything. Ask anyone who ever had to go to the DMV. We all know that and to some degree, expect it.

But the Covid relief programs have taken government mismanagement to a new level. Take the Paycheck Protection Program, which was so poorly devised and supervised that it bordered on criminal. And what happened on the other end of the PPP often WAS criminal.

The basics: The program was devised to save small businesses and their employees. The U.S. Treasury, which had just started another massive round of Quantitative Easing (i.e, “printing money”), allowed banks to loan out massive amounts of money — guaranteed by these newly minted dollars.

Oh — and Treasury also essentially doubled the amount of dollars on the Fed’s balance sheet to $8.9 trillion (inflation anyone? Those printing presses must’ve been smoldering).

The banks rushed to get these loans out to their customers. The SBA site couldn’t keep up with the loan volume and kept crashing.

Loans were pushed out anyway. After all, the banks weren’t on the hook for the money — you were.

Honest bankers began to recognize early the signs of major problems, and by May of 2020 experts were calling the program out. But the government kept the (your) money flowing until June of 2021.

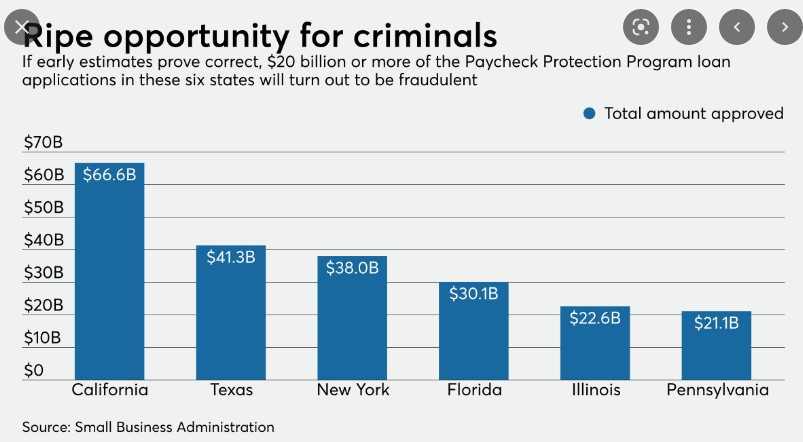

Some quick stats on the PPP:

It issued over 11 million loans

$793 billion was borrowed

$714 billion was “forgiven”

Only 25% of money got to employees

Saved jobs had an average income $58,000

72% of loans went to people in the top 20% of the economy.

The program didn’t save us from disaster — it was a disaster.

Then there’s the fraud, which is likely at least 15% (this writer would bet it’s higher). Fraud is still being identified, as even Senator Dick Durbin recently discovered.

Here’s a simple graphic on how it typically worked (source: DOJ):

As a result of all this, in the early summer of 2020 cops around the country started to see a lot of money on the street. Financial crime investigators began tying that money to fake PPP loan fraud.

It actually borders on comic. They were letting inmates apply for loans.

There has been some reporting on it — here’s a quick one from a clearly incredulous reporter, from June of this year (money line: “Oversight — it did not exist”):

That reporter’s expression says it all.

Now that DOJ sees the picture and are spinning up the obligatory task forces, we will be seeing new arrests and indictments daily — but it will not scratch the surface of the money lost.

According to the WaPo, $1.3 billion even went overseas.

And they wonder why we distrust big government.

Will anyone ever be held accountable? With inflation the #1 issue in the country, will anyone even ask Karine Jean-Pierre that question?

We know how much they spent per job… wonder how much they’ve spent per vote.

By the way, PPP fraud is not the only gift to scammers from the pandemic. Good luck identifying anyone committing bank crime these days. Hint, it’s a guy in a mask. Is the guy below cashing bad checks or just “following the science”?

Of course not everyone who goes into a bank is looking to steal, but these two probably are.

(Now those are cool masks).

Raging Snowflakes Dept: For reasons that remain obscure to us, last week’s posting on transit crime was deemed to violate Facebook’s “Community Standards.”

That’s the second time we have been so-tagged…. In policework, we call that “a clue.”

We’re annoying the right people.

Until next time… Stay safe!!